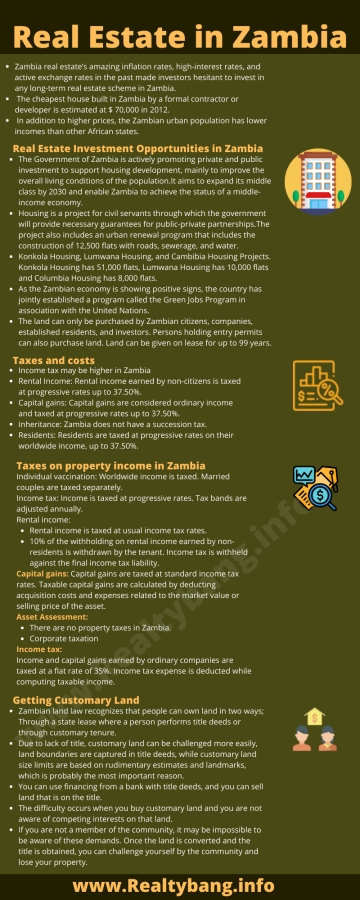

Real Estate in Zambia: Zambia real estate’s amazing inflation rates, high interest rates, and active exchange rates in the past made investors hesitant to invest in any long-term real estate scheme in Zambia.

As a result, the cost of homes in Lusaka is the highest in Africa which is directly affecting the carrying capacity of the population. The cheapest house built in Zambia by a formal contractor or developer is estimated at $ 70,000 in 2012.

In 2013, however, the estimated price rose marginally to $ 68,363. The price of a house is US $ 68,363 which is usually around US $ 30,000 in other countries. In addition to higher prices, the Zambian urban population has lower incomes than other African states.

However, domestic loans including construction finance, foreign currency loans, and mortgage loans grew 32.6% from KMW 19 to ZMW 26,164.7 million, up to 726.8 million in just six months.

Investment Opportunities in real estate in Zambia

The Government of Zambia is actively promoting private and public investment to support housing development, mainly to improve the overall living conditions of the population.

It aims to expand its middle class by 2030 and enable Zambia to achieve the status of a middle-income economy. Zambia’s real estate and construction sector offer various opportunities for investors.

- Housing is a project for civil servants through which the government will provide necessary guarantees for public-private partnerships. The project consists of 100 flats of rent-based civil servants for the purchase of schemes, including the development of basic amenities and social amenities.The project also includes an urban renewal program that includes the construction of 12,500 flats with roads, sewerage, and water.

- Konkola Housing, Lumwana Housing, and Cambibia Housing Projects. Konkola Housing has 51,000 flats, Lumwana Housing has 10,000 flats and Columbia Housing has 8,000 flats. All these projects are to be completed before 2030 in Zambia.

- As the Zambian economy is showing positive signs, the country has jointly established a program called the Green Jobs Program in association with the United Nations.This Zambian real estate and construction industry is particularly focused on generating more and better green employment in medium and low-cost housing.The plan envisages 5,000 new green jobs and 2,000 better green jobs which include Social Security, Gender Equality, Labor Law, and Health and Safety.

Zambia, east of Angola, was one of the richest countries in Africa in the 1960s. Now, it is one of the poorest. Its poverty can be referred to as a largely misleading legacy, although it is not corrupt, the president, led Kembet Kaunda to independence in Zambia in 1964.

Kaunda was committed to state-led development, particularly for copper mines. When the results were poor, Kaunda claimed strong state control. To make matters worse the world copper price fell in 1975.

By 1980, Zambia’s poverty and the suppression and corruption of his government had made Kaunda highly unpopular. In 1991, he allowed multi-party elections and lost to Frederick Chiluba.

The land can only be purchased by Zambian citizens, companies, established residents, and investors. Persons holding entry permits can also purchase land. Land can be given on lease for up to 99 years.

Taxes and costs

Income tax may be higher in Zambia

- Rental Income: Rental income earned by non-citizens is taxed at progressive rates up to 37.50%.

- Capital gains: Capital gains are considered ordinary income and taxed at progressive rates up to 37.50%.

- Inheritance: Zambia does not have a succession tax.

- Residents: Residents are taxed at progressive rates on their worldwide income, up to 37.50%.

Taxes on property income in Zambia

- Individual vaccination: Worldwide income is taxed. Married couples are taxed separately.

- Income tax: Income is taxed at progressive rates. Tax bands are adjusted annually.

Rental income:

- Rental income is taxed at usual income tax rates.

- 10% of the withholding on rental income earned by non-residents is withdrawn by the tenant. Income tax is withheld against the final income tax liability.

Capital gains: Capital gains are taxed at standard income tax rates. Taxable capital gains are calculated by deducting acquisition costs and expenses related to the market value or selling price of the asset.

Asset Assessment:

- There are no property taxes in Zambia.

- Corporate taxation

Income tax:

Income and capital gains earned by ordinary companies are taxed at a flat rate of 35%. Income tax expense is deducted while computing taxable income.

Getting Customary Land

Zambian land law recognizes that people can own land in two ways; Through a state lease where a person performs title deeds or through customary tenure, where a principal gives the person the right to occupy a piece of land.

Title deeds are conclusive proof of ownership and can only be challenged under strict conditions.

Due to lack of title, customary land can be challenged more easily, land boundaries are captured in title deeds, while customary land size limits are based on rudimentary estimates and landmarks, which is probably the most important reason.

You can use financing from a bank with title deeds, and you can sell land that is on the title, while the government prohibits the sale of customary land because it “allocates” to subjects in a major area should be done.

Because the law recognizes customary tenure, it seeks to protect those who are holding land in this manner. Moreover, even the chief should consult his subjects who may be influenced before giving their consent before conversion.

The difficulty occurs when you buy customary land and you are not aware of competing interests on that land. You can buy land from a person or village head who has ignored the interest of other members of the community who claim the land.

If you are not a member of the community, it may be impossible to be aware of these demands. Once the land is converted and the title is obtained, you can challenge yourself by the community and lose your property.

Whether you are buying state land or customary land, always make sure that you consult professional advisors to protect your interests.