Real Estate in San Diego is very competitive. Homes for sale in San Diego receive an average of 3 offers and sell in about 18 days. The city of San Diego owns a large portfolio of properties and will now need a new boss to manage it.

But more than this, the city’s most repetitive failure of clumsy and reckless acquisition of real estate has been a failure. Thompson was the second top manager amid continued revelations about the home’s purchase that hundreds of employees in the city made to occupy for a long time, potentially saving taxpayers millions in annual rents.

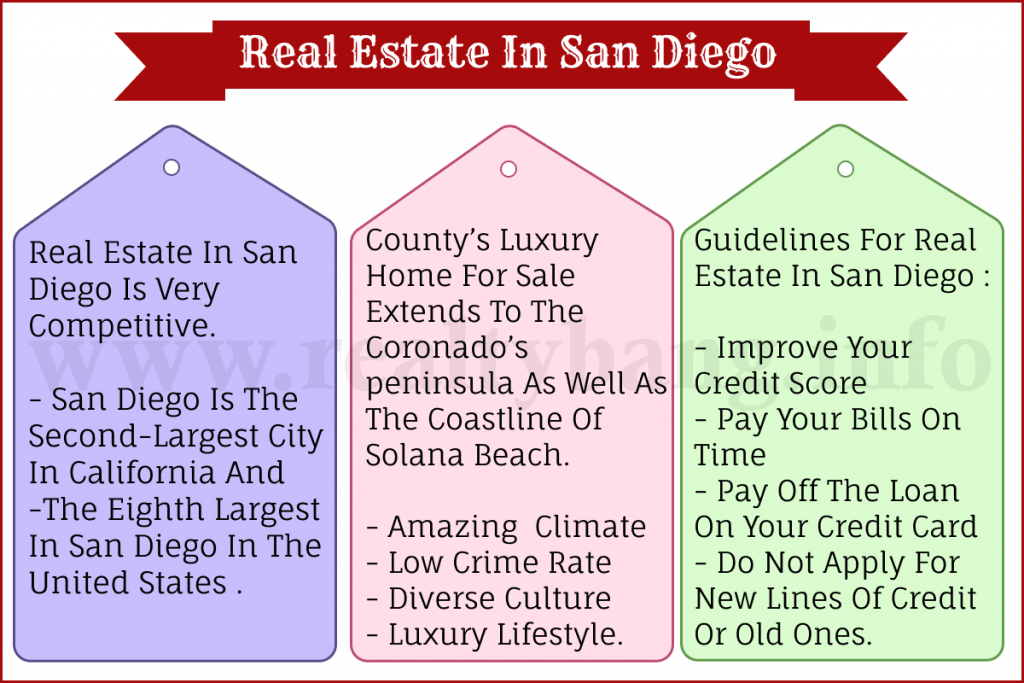

The second-largest city in California and the eighth largest in San Diego in the United States are located on the Pacific shore presently northern of the Mexican boundary. Greater luxury homes reflect the beauty of their location and are located in some of the nation’s most affluent denominations, including Rancho Santa Fe and La Jolla.

County’s luxury homes for sale market extends along the Coronado’s peninsula as well as the bay, as well as the coastline of Anicutas and Solana Beach. With an amazing subtropical climate, low crime rate, and diverse culture, County has all the ingredients necessary to enjoy a truly remarkable luxury lifestyle.

Thompson and his staff never called for an independent inspection of the home before purchasing it and claimed to the city council that it would only require a power wash.

Guidelines for Real Estate in San Diego

First of all, you can check your score once a day without damaging your account, known as a soft inquiry. Difficult inquiries occur when financial organizations check your balance, usually when you apply for a loan or credit card. Difficult inquiries reduce your score slightly, so try to keep hard inquiries to a minimum.

JUST KNOW ABOUT REAL ESTATE IN SAN DIEGO :

Improve your credit score

You may have just checked your account score and realized that it is not as high as you expected. Don’t worry, there are some things you can do right now that will help increase your stocks score so that you can capitalize on a great interest rate.

Pay your bills on time

Start paying your bills on time. Fixed automated cash for your bills or set alarms, just make sure that you can meet the scheduled dates to track all your bills. Organizing a record of paying your bills on time is supreme in developing your assets score.

Pay off the loan on your credit card

One of the biggest contributing factors to your balance score is called the balance utilization ratio. This ratio is determined by taking your average spend on all your credit cards each month and dividing by your total account limit.

Lenders want to make sure that you are not close to maximizing your credit card and prefer to see a wealth utilization ratio of 30% or less.

Do not apply for new lines of credit or old ones

Opening new lines of loans is not going to help increase your score and may in many ways be the opposite. Applying for a new card causes unnecessary inquiries into your balance history, which also negatively affects your stocks.

Closing an unused card can also have negative consequences as it also shows that you are limiting the assets available to you, increasing your account utilization ratio.

After getting your account report, you can see many mistakes that can drag your account score down. The good news is that you can correct these errors and a professional can easily erase them from your credit report so that your credit score can bounce back.

• Know what you can do

• Save for down payment

• Create your savings

• A healthy debt-to-income ratio (DTI)

• Budget for an extra cost

You may know better ideas about RENTING PROPERTY AS A FOREIGNER IN DENMARK.