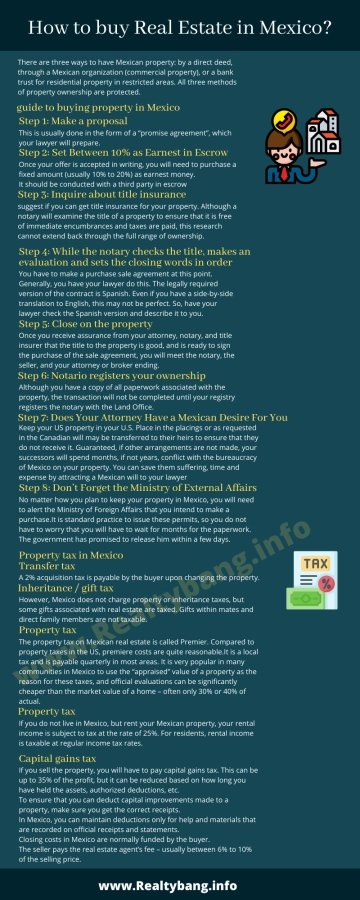

How to buy Real Estate in Mexico?: There are three ways to have Mexican property: by a direct deed, through a Mexican organization (commercial property), or a bank trust for residential property in restricted areas. All three methods of property ownership are protected.

A step-by-step guide to invest in Real Estate in Mexico

Step 1: Make a proposal

This is usually done in the form of a “promise agreement”, which your lawyer will prepare.

Step 2: Set Between 10% as Earnest in Escrow

Once your offer is accepted in writing, you will need to purchase a fixed amount (usually 10% to 20%) as earnest money. It should be conducted with a third party in escrow. Whatever you do, it does not give this money to the seller.

While they may be the logical, neutral third party to hold this money, they will not deposit it in their bank accounts, as they do not want tax liability on the funds. If you are working with a lawyer or real estate agent, they will likely have a system they can suggest.

One arrangement is for deposits in escrow in dollars in the United States. When the deal is closed, the deposit is transferred to the current exchange rate. This avoids the exchange rate problem – if the earnest money is immediately transferred to the pesos and sits around for several months and then the deal falls apart, one has to deal with currency fluctuations and the cost of the exchange. And it will probably be you, the buyer. Another option is that you have a cashier’s check in the seller’s name and have your notary attorney or a trusted third party.

Tip: buyer beware. In the US, escrow agents are licensed and legally responsibleforoensuringe that the terms of the contract are met before the money is released. Not so in Mexico. If the real estate agent you are working with is working as an escrow agent and is honest, there will probably be no trouble. But if he runs away from your fund, there may not be much for you.

Step 3: Inquire about title insurance

We suggest that you can get title insurance for your property. Although a notary will examine the title of a property to ensure that it is free of immediate encumbrances and taxes are paid, this research cannot extend back through the full range of ownership. A title insurance company, however, will dig to ensure that there are no surprises. If the title search tells you that the title is not clear, do not buy the property.

Sometimes brokers and even lawyers will tell you that title insurance is not necessary. However, we recommend that you purchase title insurance if it is available. While most likely you will never need it, you never know. If another person claims your property, Title Insurance will cover you, either by remolding you or fighting your case in court. If you do not have title insurance and something has gone wrong, you have a little recourse and what you have will likely be very expensive and take you a long time.

Step 4: The notary checks the title, makes an evaluation, and sets the closing words in order.

You have to make a purchase-sale agreement at this point. Generally, you have your lawyer do this. The legally required version of the contract is Spanish. Even if you have a side-by-side translation to English, this may not be perfect. So, have your lawyer check the Spanish version and describe it to you.

Depending on how you are purchasing the property, your lawyer can make papers for direct deeds or help you to form a Mexican corporation or a bank trust, and have him register your purchase with the ministry. Will get papers for Of foreign affairs.

Step 5: Close on the property

Once you receive assurance from your attorney, notary, and title insurer that the title to the property is good, and is ready to sign the purchase of the sale agreement, you will meet the notary, the seller, and your attorney or broker ending. You receive the deed, and you either bring a check for the balance of the payment or transfer the money to the escrow account, and whoever acts as an escrow agent is issued.

Step 6: Notario registers your ownership

Although you have a copy of all paperwork associated with the property, the transaction will not be completed until your registry registers the notary with the Land Office. We have heard all kinds of horror stories over the years about not completing this last phase properly.

Step 7: Does Your Attorney Have a Mexican Desire For You

Tip: Keep your US property in your U.S. Place in the placings or as requested in Canada will be transferred to their heirs to ensure that they do not receive it. Guaranteed, if other arrangements are not made, your successors will spend months, if not years, in conflict with the bureaucracy of Mexico on your property. You can save them suffering, time, and expense by attracting a Mexican will to your lawyer, the Spanishdisposede of their Mexican property and possessions.

Step 8: Don’t Forget the Ministry of External Affairs

No matter how you plan to keep your property in Mexico, you will need to alert the Ministry of Foreign Affairs that you intend to make a purchase. As we have previously mentioned, it is usually your lawyer or notary who applies for a permit on your behalf before closing. It is standard practice to issue these permits, so you do not have to worry that you will have to wait for months for the paperwork. The government has promised to release him within a few days.

If you are purchasing through trust and you apply for your permit through the central office of the ministry in Mexico City, you will have it within five working days. If you apply to the state office, permission must be given within 30 days.

If you are building a Mexican corporation that will hold title to the property, then you must register that company with the Ministry of Foreign Affairs. The ministry has 15 days to register. In any of these cases, if the ministry deadline passes and you still haven’t heard anything, the trust permit or registration is automatically considered authorized.

Property tax in Mexico

Transfer tax

A 2% acquisition tax is payable by the buyer upon changing the property.

Inheritance/gift tax

However, Mexico does not charge property or inheritance taxes, but some gifts associated with real estate are taxed. Gifts within mates and direct family members are not taxable.

Property tax

The property tax on Mexican real estate is called Premier. Compared to property taxes in the US, premiere costs are quite reasonable. It is a local tax and is payable quarterly in most areas. The estimated value is approximately 0.1% of the average asset at the time of sale.

It is very popular in many communities in Mexico to use the “appraised” value of a property as the reason for these taxes, and official evaluations can be significantly cheaper than the market value of a home – often only 30% or 40% of actual. However, you should know that under Mexican law, it is illegal to use an appraised value less than the actual commercial value for tax purposes. And, this means that when you sell you will pay more capital gains tax.

Rental Income Tax

If you do not live in Mexico, but rent your Mexican property, your rental income is subject to tax at the rate of 25%. For residents, rental income is taxable at regular income tax rates.

Capital gains tax

If you sell the property, you will have to pay capital gains tax. This can be up to 35% of the profit, but it can be reduced based on how long you have held the assets, authorized deductions, etc.

To ensure that you can deduct capital improvements made to a property, make sure you get the correct receipts. In Mexico, you can maintain deductions only for help and materials that are recorded on official receipts and statements.

Closing costs in Mexico are normally funded by the buyer. In a regular transaction, closing fees typically fall between 5% and 8% of the cost of the asset. The fee will include acquisition tax, property-registration fee, fee for a tax certificate, title-search fee, property-appraisal fee, notary’s fee, and any miscellaneous clerical fee as well as value-added tax.

Whose services were engaged in facilitating transactions? When you make your offer, you can estimate these fees from your notary and/or real estate agent.

The seller pays the real estate agent’s fee – usually between 6% to 10% of the selling price.