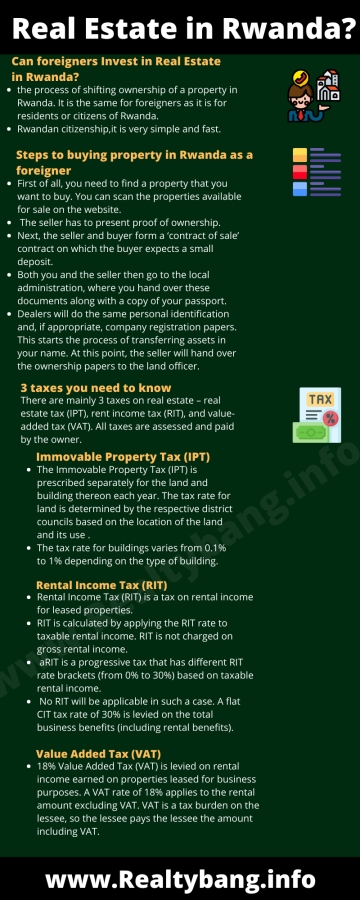

Real Estate in Rwanda?: This is one of the questions that we get asked the most. The simple answer is yes! You can buy property in Rwanda even if you do not have Rwandan citizenship. And, even better, it is very simple and fast.

Below we explain the process of shifting ownership of a property in Rwanda. It is the same for foreigners as it is for residents or citizens of Rwanda.

Steps to buying property in Real Estate in Rwanda:

First of all, you need to find a property that you want to buy. You can scan the properties available for sale on the website, and want to know that Can foreigners Invest in Real Estate in Rwanda?

Then the seller has to present proof of ownership. At Vibe House, we always check all relevant documents of the seller, so you don’t have to worry about it.

Next, the seller and buyer form a ‘contract of sale’ contract on which the buyer expects a small deposit.

Both you and the seller then go to the local administration, where you hand over these documents along with a copy of your passport. Dealers will do the same personal identification and, if appropriate, company registration papers. This starts the process of transferring assets in your name. At this point, the seller will hand over the ownership papers to the land officer.

Note that just before doing this, the entire amount has to be paid by bank transfer. If you are buying property in both your and your spouse’s name, you will need a written, signed, and notarized power of attorney from them if they are not present in the office. This should be accompanied by a copy of their passport and the number mentioned in the power of attorney.

The local administration will prove the request and all the documents submitted and then start the process of transfer of the property to you. The process of changing ownership as well as receiving the paperwork takes about 1-2 weeks. We will follow it up for you.

Rwanda’s real estate and property market brings a lot of domestic and foreign investment. If you are planning to invest in real estate in Rwanda (land, residential/commercial building), it is important to have an understanding of all the taxes involved, as the tax implications of buying and/or renting a property in Rwanda, Africa are significant to have an impact on. on your return on investment. This guide presents a simple summary of taxes on real estate that will help you make an informed decision.

3 taxes you need to know

There are mainly 3 taxes on real estate – real estate tax (IPT), rent income tax (RIT), and value-added tax (VAT). All taxes are assessed and paid by the owner. If the owner is not located in Rwanda, a proxy can be appointed in Rwanda for tax purposes. Taxes must be declared and paid every year.

Immovable Property Tax (IPT)

The Immovable Property Tax (IPT) is prescribed separately for the land and building thereon each year. The tax rate for land is determined by the respective district councils based on the location of the land and its use and ranges up to Frw 300 per square meter. This tax rate is multiplied by the entire surface area of the land plot to calculate IPT on land.

The tax rate for buildings varies from 0.1% to 1% depending on the type of building. The tax rate is calculated by the market value of the building to determine IPT on the building. The market value of a building should be assessed every 5 years by a certified appraiser.

RENTAL INCOME TAX (RIT)

Rental Income Tax (RIT) is a tax on rental income for leased properties. Anyone earning only rental income without any income from any other business in Rwanda must register for the RIT and submit the rental contract to the RRA within 15 days.

RIT is calculated by applying the RIT rate to taxable rental income. RIT is not charged on gross rental income. Taxable rental income is calculated by subtracting certain allowed expenses from the gross rental income. Firstly, a flat 50% of the gross rental income earned during the year is allowed as a deduction. It is considered a maintenance and repair expense that does not require any supporting documentation.

Secondly, bank interest charged for the purchase and construction of the property is also allowed as a deduction. RIT is a progressive tax that has different RIT rate brackets (from 0% to 30%) based on taxable rental income.

If the person is registered under Corporate Income Tax (CIT), then rental income can be consolidated with other business income under CIT. No RIT will be applicable in such a case. A flat CIT tax rate of 30% is levied on the total business benefits (including rental benefits). Business profit is calculated after providing for deductible business costs.

These expenses should be incurred for the direct purpose of the business and certified with proper purchase receipts. Depreciation allowance at 5% of the cost of the building is also allowed as a deductible expense. No depreciation allowance can be claimed at the cost of land. Interest expense for the direct purpose of the business is also an allowable deduction for computing business profit.

Value Added Tax (VAT)

Eventually, an 18% Value Added Tax (VAT) is levied on rental income earned on properties leased for business purposes. A VAT rate of 18% applies to the rental amount excluding VAT. VAT is a tax burden on the lessee, so the lessee pays the lessee the amount including VAT. The lessee is required to collect VAT and pay it to the tax authorities. The lease agreement should mention the amount of rent excluding VAT and the amount of rent inclusive of VAT.

Know every detailed information about Rwanda and Can foreigners Invest in Real Estate in Rwanda? at https://www.gov.rw/